It’s fair to say that a lot has happened with house prices in Nottingham during 2018. We’ve seen continuing shifts in tenant demographics, increasing tenant demand , better rental yields and also perhaps the busiest year we’ve had to date. Most recently however, the licensing of over 35,000 rental properties by both Nottingham City and Gedling Borough council marks an unprecedented change in the way landlords in Nottingham are required to now operate on a day to day basis.

Many have said that property investing in Nottingham is now a lost cause, but is this really the case? Whilst many private and institutional landlords will look dimly on current market conditions, others are ceasing opportunities and making a continued success of their property investment.

Below – and in a series of forthcoming emails – we will be taking a high level overview of the Nottingham property market and providing you with everything you need to know if you are thinking of investing in Nottingham property.

House prices Nottingham – Price Growth Chart

Nottingham as a whole has performed very well in 2018 in terms of overall house price growth compared with other cities. Figures released by Hometrack show an average price increase of 5.4% over the past 12 months. This placed Nottingham in 8th position across the UK, delivering better results than cities such as Leeds (4.3%), Bristol (1.2%) and London (which has actually fallen in price by 0.4%). The average house price for Nottingham currently sits at £152,300, an increase from circa £144,000 one year ago.

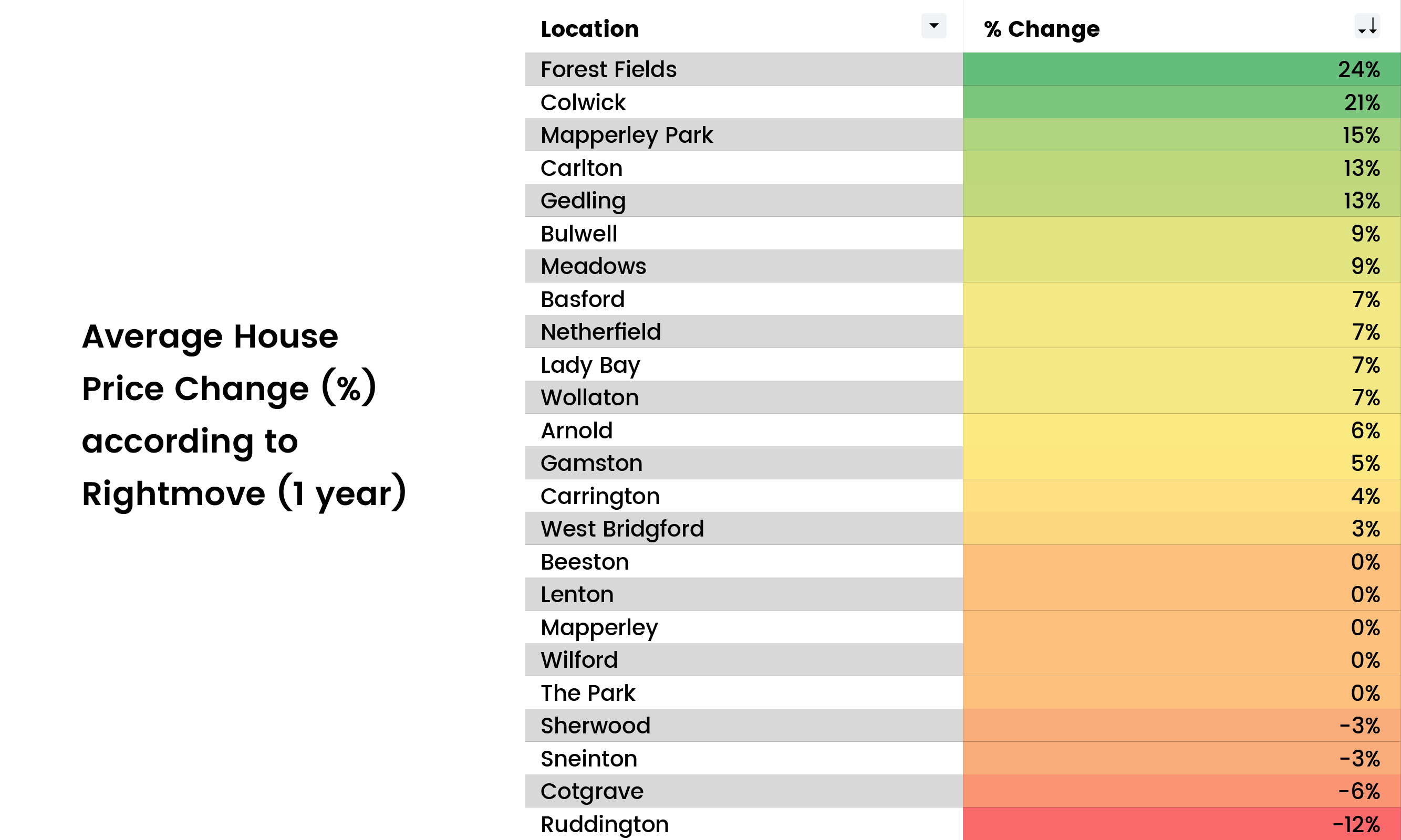

Looking more specifically within Nottingham itself, we have created a table providing approximate how house prices in Nottingham have changed over the past 12 months, according to Rightmove.co.uk

You can view the table below:

Interestingly, Forest Fields tops the list and has done particularly well although it’s important to be aware that this could be a slightly misleading statistic. We have seen a marked increase in the sale of HMO / Student properties in this area as a result of an increasing tenant demand for higher quality living spaces, alongside somewhat of a environmental clamp-down by Nottingham City Council. No longer is it feasible to expect to rent out sub-standard properties and remain profitable. Couple this with the premium prices being obtained for properties with existing HMO / Additional licences and this could go a long way towards explaining why Forest Fields has done so well.

Family favourites Carlton & Gedling continue to offer sustainable growth in the mid range price point with plenty of demand across all property types. Colwick has performed particularly well and this could be as a result of it’s relative ease of travel into Nottingham City Centre coupled with increasing infrastructure development nearby.

Perhaps most surprisingly are some of the higher end areas – West Bridgford (3%), The Park (0%) and Ruddington (-12%) all showing signs of slowing down following what have been fantastic years previously. That’s not to say that there isn’t still demand in these areas, but it could be said that we are seeing somewhat of a correlation to national trends whereby the more desirable locations are starting to see house prices stabilise as the market cools off from a boom. House prices in Nottingham by comparison have performed well.

What about asking rents?

We cannot outline potential capital growth opportunities without also discussing asking rents. Whether you are focusing purely on yield or not, this should play a key part in your decision making process when searching for your next buy to let investment property.

As landlords continue to be squeezed financially by way of Section 24 tax restrictions and the implementation of government legislation, we have seen a marked rise in rents across our managed property portfolio. Many landlords now simply have no choice but to increase rents to cover costs. Despite the ongoing portrayal of landlords rolling in money, the reality is that for the vast majority this simply couldn’t be further from the truth.

This doesn’t necessarily mean that yields – or returns on investment – are increasing however. In fact despite increasing the asking rent of a property this can be quite the opposite. A simple calculation on a property now requiring a selective licence in Nottingham and assuming a mere £25pcm increase in rent, the result is over 2.5 years to recoup the licence outlay!

Perhaps the most unfortunate result of this is that in most cases neither the landlord nor the tenant gain when a property requires a licence. The question therefore is why couldn’t Nottingham City Council have implemented a more focussed approach on unscrupulous landlords instead of introducing a blanket scheme?

According to this article by the Nottingham Post the average rental figure for Nottingham currently stands at £628pcm, a rise of only 1.6% when compared with a year ago. We suspect however that we will see this figure increase quite significantly in the coming months as many landlords continue to feel the pinch of the governments continued control of the private rental sector. We wait to see what happens with house prices in Nottingham.

Looking inwards at our 400+ managed property portfolio in Nottingham and it’s clear to see that some areas have stood out from the rest as far as overall demand and achieved rental figures are concerned. Notably we have seen strong increases in The Meadows, Nottingham City Centre, Gedling, Carlton and Colwick. West Bridgford again has experienced somewhat of a lull in overall asking prices, however demand has remained consistent with many properties having been ‘let agreed’ provided they are being marketed at realistic asking prices.

Summary

It’s fair to say that house prices in Nottingham have attracted a lot of interest from property investors nationwide. A number of large developments and advances in infrastructure continue to drive demand, and subsequent asking prices at a consistent pace.

One thing is for sure – Nottingham offers a safe haven for those wishing to invest in residential property provided investors buy in the right areas. Knowing what to expect from tenants and then allowing for a reasonable outcome will be the key here.

If you are thinking of investing in Nottingham but don’t really know where to start, why not contact us for a 1-2-1 property consultation? We can help you to discover which areas will work for you based on your budget, strategy and desired outcome. After all, who best to help than the people that live and breath Nottingham property every single day?

Has this article been helpful? Let us know by leaving a comment below.

Leave A Comment